5558 Extension Form: Get a Delay to File Employee Plan Returns

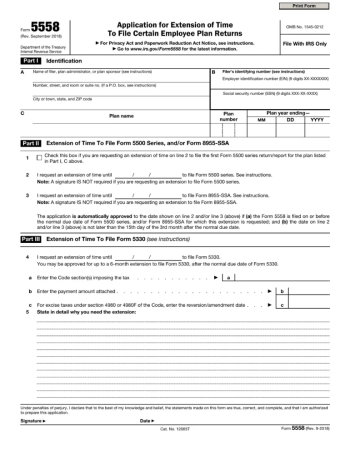

IRS Form 5558 is a specialized document designed for taxpayers who require additional time to complete specific tax-related filings. Individuals and businesses can use Form 5558 for an extension for 2022 on filings related to employee benefit plans, health savings accounts, Archer Medical Savings Accounts (MSAs), or other such programs. To file Form 5558, one must accurately complete the required sections and adhere to the associated deadlines for their specific tax obligations.

The 5558 Form Purpose

The IRS Form 5558 is a crucial document for individuals requiring extensions on certain tax-related deadlines. Those who need additional time to report their Annual Return/Report of Employee Benefit Plan (5500 series) or the 8955-SSA document must file the 5558 extension form.

A valuable resource to assist with this process is our website, 5558taxform.com. Our online platform provides a comprehensive set of materials, including step-by-step instructions and practical examples, to guide users through the complexities of IRS Form 5558. By exploring this site, taxpayers can not only download the 5558 form with ease but also gain a deeper understanding of the form's requirements and nuances. Moreover, 5558taxform.com's extensive resources and expert insights enable users to navigate the extension process confidently, reducing stress and boosting the likelihood of a successful filing experience. In summary, the website serves as an essential tool for taxpayers needing extra time to prepare their financial documents thoroughly and accurately.

Reasons to File Form 5558 in 2023

- Consider the case of Sarah, a small business owner, and diligent taxpayer. She had always met her tax filing deadlines in the past. However, a recent family emergency left her overwhelmed, unable to complete her Employee Benefit Plan report in time. Upon discovering the IRS Form 5558 instructions online, Sarah realized she had an opportunity to obtain the necessary extension on her 5500 return filing deadline.

- Fortunately, Sarah promptly filed the IRS 5558 form, enabling her to secure an extension that allowed her the needed time to complete her tax duties accurately. This helped her maintain compliance with IRS regulations and avoid potential penalties. Thus, taxpayers like Sarah need to be familiar with the available resources when faced with time constraints, ensuring timely and efficient fulfillment of tax filing responsibilities.

To ensure a seamless filing experience on our website, adhere to the following steps for completing IRS Form 5558 for the 2022 calendar period without errors.

Filling Instructions for Form 5558 From A to Z

- Begin by accessing the Form 5558 PDF from our friendly website as printable and fillable templates.

- Carefully review the instructions accompanying the sample to familiarize yourself with the requirements and guidelines.

- Fill in the necessary personal information, including your name, address, and taxpayer identification number.

- Proceed to indicate the type of return for which you are requesting an extension— 5500, 8955-SSA, or 5558.

- Accurately calculate and document the required extension length, ensuring that it adheres to the IRS's stipulated maximum durations.

- Sign and date Form 5558 for an extension of time, along with providing any additional information mandated by the IRS.

- Prior to submission, thoroughly review your entries to identify and rectify any errors or omissions, guaranteeing their accuracy.

- Once finalized, submit the completed Form 5558 to the IRS within the designated time frame.

- Keep a copy of the submitted request for your records and for reference in case any follow-up or correspondence with the IRS is necessary.

When File Form 5558 to Get Time Extension

Filing the 5558 application is set to provide taxpayers with sufficient time to complete the necessary paperwork. According to the instructions for Form 5558, this deadline typically falls on the 15th day of the fifth month following the close of the tax year. This specific due date ensures that taxpayers have ample opportunity to gather relevant documents and information.

Important Note

The proper utilization of IRS Form 5558 can grant much-needed extensions for a range of tax returns and obligations. As a general rule, one should submit a separate copy of Form 5558 for each tax return requiring an extension. Nevertheless, individuals dealing with multiple benefit plans that share a single plan number and the same plan year are granted the flexibility to use a single form. Diligence and attention to detail when completing the 5558 form ultimately lead to a smoother tax extension process.

IRS 5558 Form: Popular Questions

- What is the purpose of IRS tax form 5558?The primary purpose is to request an extension for the filing of certain employee benefit plan returns, specifically 5500 and 8955-SSA forms. By submitting this form, administrators can receive additional time to prepare and submit accurate returns for plans subject to the Employee Retirement Income Security Act (ERISA).

- Can I access and submit IRS Form 5558 online?Yes, you can access the 5558 template through the online tax service providers. Although the application itself is not submitted electronically, you can download, fill in the required information, print it out, and then mail it to the IRS within the specified deadline.

- How can someone complete an IRS Form 5558 fillable?Open the PDF document by following the link on our website. You can fill out the required fields directly on your computer or other electronic devices, then print and sign the document before submitting it to the IRS by mail.

- What details should be included in a sample of Form 5558?Ensure that the following information is correctly provided: the filer's name, address, employer identification number (EIN), plan numbers, the type of return for which an extension is needed (5500 tax return series or the 8955-SSA sample), and the plan's intended filing date. Double-check all information to ensure accuracy before submission.

- How much additional time is granted when submitting IRS Form 5558 for an extension?You can receive an additional 2.5 months for filing Form 5500 series and an extra 6 months for filing the 8955-SSA. This prolonged deadline provides plan administrators with enough time to collect necessary data and submit complete, accurate information to the IRS.

IRS Form 5558: Related Materials

-

![image]() IRS Form 5558 Instructions Understanding the requirements and benefits of various tax forms can be a daunting task for anyone. In this article, we will provide you with a concise and clear explanation of Form 5558, delving into its purpose, constraints, and potential applications. Our goal is to aid you in comprehending this... Fill Now

IRS Form 5558 Instructions Understanding the requirements and benefits of various tax forms can be a daunting task for anyone. In this article, we will provide you with a concise and clear explanation of Form 5558, delving into its purpose, constraints, and potential applications. Our goal is to aid you in comprehending this... Fill Now -

![image]() IRS Form 5558 Form 5558, a document filed with the Internal Revenue Service (IRS), serves as an Application for Extension of Time To File Certain Employee Plan Returns. This extension allows taxpayers additional time to file specific tax forms, such as 5500, 5500-SF, and 5500-EZ, which are related to benefit and... Fill Now

IRS Form 5558 Form 5558, a document filed with the Internal Revenue Service (IRS), serves as an Application for Extension of Time To File Certain Employee Plan Returns. This extension allows taxpayers additional time to file specific tax forms, such as 5500, 5500-SF, and 5500-EZ, which are related to benefit and... Fill Now