IRS Form 5558: The Latest Demands & Terms

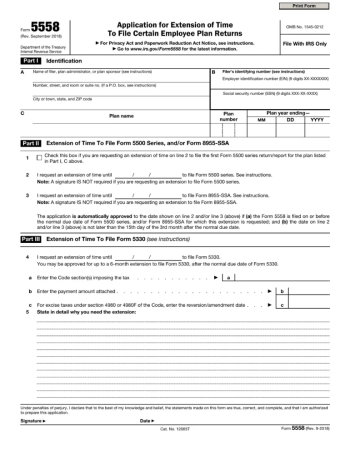

Form 5558, a document filed with the Internal Revenue Service (IRS), serves as an Application for Extension of Time To File Certain Employee Plan Returns. This extension allows taxpayers additional time to file specific tax forms, such as 5500, 5500-SF, and 5500-EZ, which are related to benefit and retirement plans. While dealing with IRS Form 5558 for an extension, one can request a 2.5-month extension to meet the filing deadline.

5558 Extension Form: Notable Changes

It is essential to keep track of updates made to various annual forms, including IRS 5558, to avoid complications during tax filing. Historically, the IRS made a significant change by removing the automatic 6-month extension for Form 5500 series returns and replacing it with the 2.5-month extension provided by Form 5558. Taxpayers should familiarize themselves with the most recent version of the form, ensuring they are working with accurate information and following up-to-date regulations.

IRS 5558 Form: Qualified and Unqualified Applicants

Not everyone is eligible to file Form 5558; qualified applicants include individuals and businesses responsible for reporting specific employee benefit plans and retirement savings plans. Examples of these include administrators of pension and profit-sharing plans, as well as those managing health and welfare benefit plans. On the other hand, those unqualified to utilize IRS Form 5558 online are taxpayers filing personal income tax returns, business income tax returns, or forms unrelated to employee retirement and benefit plans.

Recommendations for Maximizing the Form's Benefits

To reap the full benefits of Form 5558, follow these recommendations:

- Pay close attention to the deadlines

The extension request should be filed before the original due date of the tax form in question. Failure to submit Form 5558 on time could result in penalties and unnecessary complications in the tax filing process. - Complete the form accurately

Ensure that all relevant information is filled out correctly, including the tax form number, relevant plan details, and employer identification number (EIN). Filing an incorrect or incomplete form could lead to the IRS denying the extension request. - Keep a copy for your records

Keeping a copy of the completed IRS tax form 5558 can serve as evidence that you filed for an extension in case of any issues or discrepancies that may occur later in the tax filing process. - Seek professional advice if needed

If you have any doubts or concerns about the tax filing process, consult the advisor to ensure you are not missing any crucial information or making costly mistakes.

Form 5558 serves as a valuable tool for those seeking to file an extension for certain employee plan returns. By staying updated on changes to the form, understanding eligibility guidelines, and following best practices, taxpayers can effectively maximize the benefits of this extension and avoid complications in the tax filing process.

Related Forms

-

![image]() 5558 IRS Form 5558 is a specialized document designed for taxpayers who require additional time to complete specific tax-related filings. Individuals and businesses can use Form 5558 for an extension for 2022 on filings related to employee benefit plans, health savings accounts, Archer Medical Savings Accounts (MSAs), or other such programs. To file Form 5558, one must accurately complete the required sections and adhere to the associated deadlines for their specific tax obligations. Fill Now

5558 IRS Form 5558 is a specialized document designed for taxpayers who require additional time to complete specific tax-related filings. Individuals and businesses can use Form 5558 for an extension for 2022 on filings related to employee benefit plans, health savings accounts, Archer Medical Savings Accounts (MSAs), or other such programs. To file Form 5558, one must accurately complete the required sections and adhere to the associated deadlines for their specific tax obligations. Fill Now -

![image]() IRS Form 5558 Instructions Understanding the requirements and benefits of various tax forms can be a daunting task for anyone. In this article, we will provide you with a concise and clear explanation of Form 5558, delving into its purpose, constraints, and potential applications. Our goal is to aid you in comprehending this essential document while simultaneously offering practical advice for navigation and usage. Understanding the Purpose of IRS Form 5558 Form 5558 is utilized to request an extension of time to file specific returns and reports related to employee benefits plans. By submitting Form 5558 to the IRS, taxpayers or plan administrators can significantly extend the due date of required documents without facing penalties. To better grasp its importance, we will examine the individuals it addresses and its most common use cases. Ineligible Users of the 5558 Extension Form It is crucial to know that not every taxpayer can benefit from this extension form. Certain individuals are considered ineligible. Key examples include: Taxpayers who are already filing an extension application for individual income tax returns. Individuals seeking an extension for employment tax returns. Administrators responsible for filing consolidated returns that cover multiple entities. For those who find themselves ineligible for an extension using Form 5558, it is advisable to seek the appropriate form or alternative measures according to IRS instructions. Form 5558's Usefulness through a Hypothetical Scenario To truly appreciate the usefulness of IRS Form 5558, let's consider a hypothetical scenario. Suppose a plan administrator is responsible for filing a Form 5500 for an employee benefits plan. Unfortunately, they realize they may not submit it by the initial deadline. By submitting Form 5558, they can request an additional two and a half months to complete and send in the required paperwork without incurring any penalties. IRS Tax Form 5558: Common Issues and Corresponding Solutions Common Issues Solutions Unclear on the extension period provided by Form 5558 Refer to the specific Instructions for Form 5558, highlighting the extension approval date for each applicable tax form Filing Form 5558 past the original due deadline Ensure you submit Form 5558 to the IRS before the initial deadline to avoid late penalties and fees Not receiving an extension confirmation Consult IRS 5558 form instructions on checking the status of your request or contacting the IRS for additional information A well-rounded understanding of Form 5558 can benefit both taxpayers and plan administrators in need of additional time. By adhering to the principles outlined in this article and consulting the official IRS Form 5558 instructions, you can expertly navigate the process and reduce the chances of complications or errors. Fill Now

IRS Form 5558 Instructions Understanding the requirements and benefits of various tax forms can be a daunting task for anyone. In this article, we will provide you with a concise and clear explanation of Form 5558, delving into its purpose, constraints, and potential applications. Our goal is to aid you in comprehending this essential document while simultaneously offering practical advice for navigation and usage. Understanding the Purpose of IRS Form 5558 Form 5558 is utilized to request an extension of time to file specific returns and reports related to employee benefits plans. By submitting Form 5558 to the IRS, taxpayers or plan administrators can significantly extend the due date of required documents without facing penalties. To better grasp its importance, we will examine the individuals it addresses and its most common use cases. Ineligible Users of the 5558 Extension Form It is crucial to know that not every taxpayer can benefit from this extension form. Certain individuals are considered ineligible. Key examples include: Taxpayers who are already filing an extension application for individual income tax returns. Individuals seeking an extension for employment tax returns. Administrators responsible for filing consolidated returns that cover multiple entities. For those who find themselves ineligible for an extension using Form 5558, it is advisable to seek the appropriate form or alternative measures according to IRS instructions. Form 5558's Usefulness through a Hypothetical Scenario To truly appreciate the usefulness of IRS Form 5558, let's consider a hypothetical scenario. Suppose a plan administrator is responsible for filing a Form 5500 for an employee benefits plan. Unfortunately, they realize they may not submit it by the initial deadline. By submitting Form 5558, they can request an additional two and a half months to complete and send in the required paperwork without incurring any penalties. IRS Tax Form 5558: Common Issues and Corresponding Solutions Common Issues Solutions Unclear on the extension period provided by Form 5558 Refer to the specific Instructions for Form 5558, highlighting the extension approval date for each applicable tax form Filing Form 5558 past the original due deadline Ensure you submit Form 5558 to the IRS before the initial deadline to avoid late penalties and fees Not receiving an extension confirmation Consult IRS 5558 form instructions on checking the status of your request or contacting the IRS for additional information A well-rounded understanding of Form 5558 can benefit both taxpayers and plan administrators in need of additional time. By adhering to the principles outlined in this article and consulting the official IRS Form 5558 instructions, you can expertly navigate the process and reduce the chances of complications or errors. Fill Now